Heads up! Fair Issac Corporation (FICO) is changing things up. And, as a result, credit score scoring model changes are coming soon. Which also means your credit score could go up, but it could also go down.

How Your Credit Score is Currently Calculated

As many of us know, our FICO (credit) score plays a huge roll in whether or not you get approved for your credit card(s). And, the current model, is pretty easy to understand. That’s because, at the moment anyway, the biggest factor impacting your credit score is your Payment History (35%). The next biggest factor is the Total Amount You Owe (30%) which compares your total current balances versus your current available credit.

The three remaining factors that are taken into account play a much smaller roll in calculating your score. But, they still matter. The biggest of those is the length of your Credit History (15%) which is an average based on the ages of your oldest and newest accounts. Next is your Credit Mix (10%) which is the types of credit you have – loans, cards, etc. And, the final element is New Lines (10%) which takes into account new lines you open.

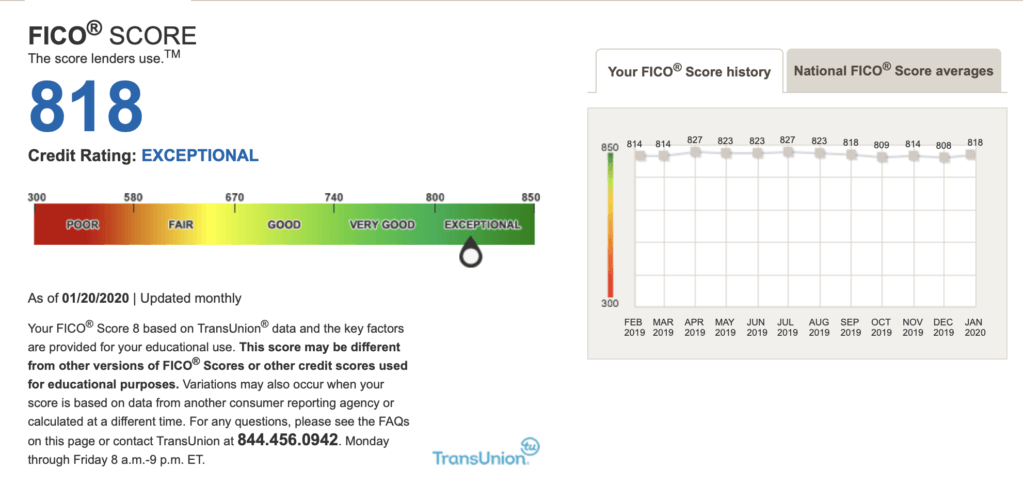

Under the current model, my score fluctuates between 800 and 817. And that’s with me opening a new card or two every year! My oldest line, my Chase Freedom, is 14 years old this year. But, it’s important to note that the current model is a snapshot based on current activity. That, as we know, is about to change.

New FICO Model

This summer, FICO is updating its scoring model to take a more holistic, backward-looking view. Model 10, as they’re calling the new model, will look at your payment history, balances over the past two years, and specific types of credit taken. On the surface, that doesn’t sound too different. But, it is.

According to an article by CNBC, the consumers that have high-utilization rates, have had missed payments/delinquencies, or have had many personal loans or credit cards will see a dip in their score when the new model goes into effect. The current estimate is that 110 million consumers will see their score change by 20 points or less. While 80 million consumers will see their score change by more than 20 points. Given the upcoming changes, experts expect that consumers with good credit will continue to enjoy high scores. However, those with scores of 600 and lower will likely see large drops and will have a much harder time trying to improve their score.

The Effects of Model 10

Though FICO Model 10 comes out this summer, it could be a while before banks begin using it. After all, American Express still uses Model 8 to score us, which came out in 2009. In fact, there is a Model 9 that came out in 2014, but few lenders use it today. Further, some financial institutions are abandoning FICO scores altogether and are moving over to the VantageScore, which is from the credit bureaus – Experian, Equifax, and Trans Union.

It’s worth noting that VantageScore uses similar models to FICO. However, VantageScore 4.0, which came out in 2017, is quite similar to FICO Model 10. So if you’ve already seen your VantageScore 4.0 score, then I’d say you probably have a good idea of what your new FICO score will look like. Unfortunately, I haven’t seen what my score looks like with VantageScore 4.0. Credit Karma, which uses Vantage, currently displays VantageScore 3.0.

Credit Score Scoring Model Changes are Coming Soon, Final Thoughts

At the end of the day, credit scoring models change every few years. As a result, while we should be mindful of these changes, we shouldn’t focus on them too much. Instead, it’s important to ensure you use credit responsibly. So, always pay your bills on-time, don’t carry large balances, make sure you keep your utilization under 30% (less is better!), and try to keep your use of risky credit (personal loans and credit cards – I know lol) to a minimum.