Earlier this week, I reported on changes coming to the American Express Gold card. Well, it seems that those rumors were correct. So, let’s go over all of the Amex Gold 2024 updates so you can see if the card is still worth it to you.

The Amex Gold card hasn’t lived in my wallet for a while now. While it has excellent features, some of which truly would benefit me, I got fed up with Amex’s coupon-book strategy for providing certain benefits, especially the way in which they limit their use. The dining credit, in particular, annoyed the hell out of me, as the $10/month credit was a laughable sum for the places that did qualify, while the cheaper options simply don’t exist in my market. Of course, to many, the card is still worth it, though the Amex Gold 2024 updates may throw your calculus into question.

Amex Gold 2024 Updates

As rumored, the most egregious of the Amex Gold 2024 updates has been confirmed – an annual fee hike of $75 to $325 per year. Those who already have the card will see their annual fee increase during their next renewal after 10/1/2024. Accompanying that hike are the following changes:

- New “white” color (pictured above)

- Dunkin’ credit of $7/month

- $50 semi-annual Resy credit

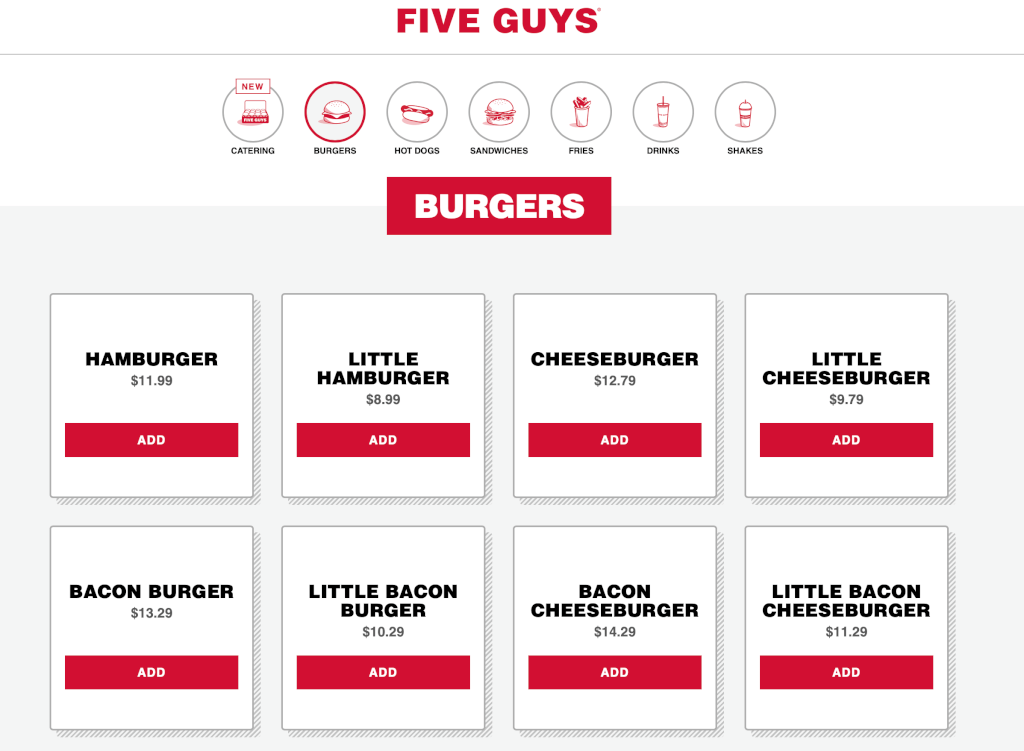

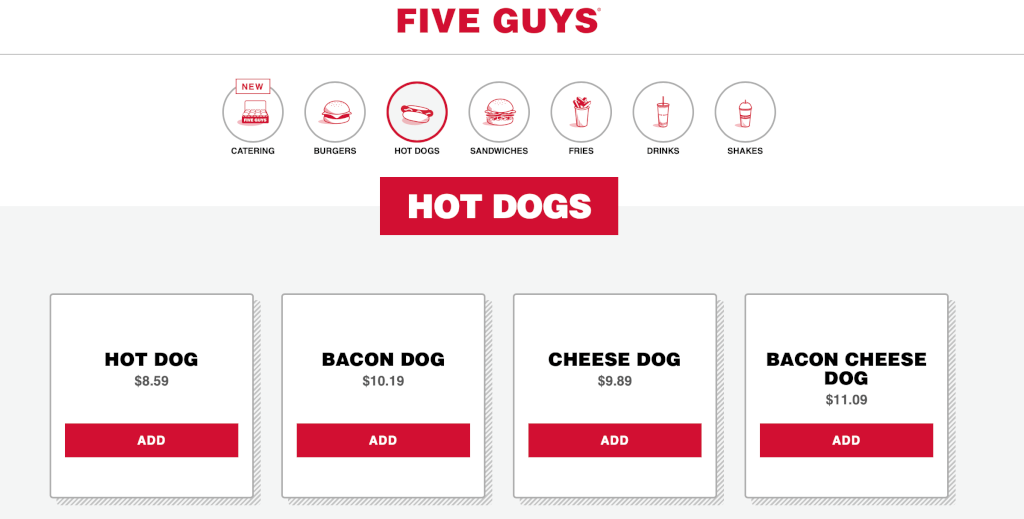

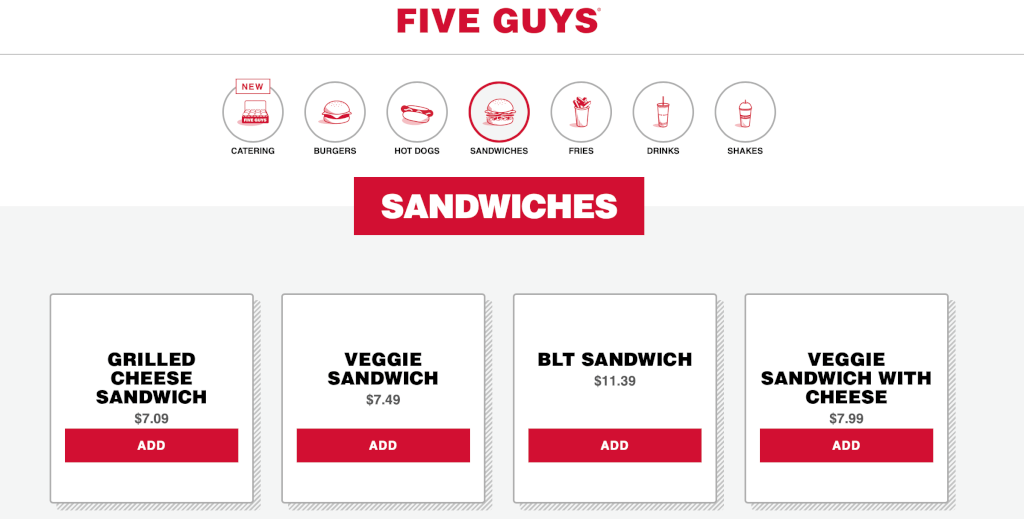

- $10/month dining credit drops Shake Shack and MilkBar as of 9/25/2024 but adds Five Guys

- A $50,000 cap now applies to the 4x dining benefit

Of course, that means the following benefits aren’t changing:

- 4x points at U.S. grocery stores on up to $25,000 in purchases annually

- 3x points on flights booked directly with airlines or via Amex Travel

- 1x points on all other purchases

- $100 experience credit with The Hotel Collection properties when you book a minimum 2-night stay

- $10/month Uber credit

- No foreign transaction fee

Dunkin’ Benefit

As is often the case, there are more nuances to the benefits than meets the eye. So, let’s go over some of the Amex Gold 2024 updates in greater detail. First up is the Dunkin’ benefit. As I stated above, this is dolled out as $7 monthly statement credits. However, it’s worth noting that some Dunkin’ locations may not accept Amex – after all, many are franchises. Moreover, you must make your purchase directly with Dunkin’ – for example, orders via DoorDash won’t count – and purchases made at Dunkin’ locations inside another business – for example, a gas station – won’t count, either. Gift card purchases also do not qualify.

You must enroll via Amex.com or through their app to use this benefit.

Resy Credit

The $50 semi-annual Resy credit will be doled out based on calendar years—not cardholder years. So, your first Resy credit of the year will be valid for use from January through June, while the second will be available from July through December. Qualifying transactions include purchases made directly with restaurants offering reservations via Resy or through Resy.com or the Resy app. Purchases of Amex-branded Resy gift cards don’t qualify, while gift card purchases made at restaurants may not qualify, either.

It’s important to note that the restaurant you dine at must be part of Resy when you dine to receive the credit. If you make your reservation with Resy, and the restaurant pulls out of the system before your visit, you won’t receive the credit.

You must enroll via Amex.com or through their app to use this benefit.

Monthly Dining Credit

I was a bit surprised to see this change in the overall Amex Gold 2024 updates. While I love MilkBar and Shake Shack, both are useless outside of very specific markets, so this makes sense. Adding Five Guys also makes sense, as it’s a fairly common chain. However, they’re also fairly expensive – IIRC, the one and only time I dined there, I ended up spending over $50 for two burgers, fries, and shakes, and that was pre-COVID. At best, the credit will get you a little burger, a basic hot do, a grilled cheese, or a veggie sandwich without exceeding the $10 credit amount.

Of course, aside from MilkBar, Shake Shack, and Five Guys, the other dining options remain unchanged, including Cheesecake Factory, Goldbelly, Wine.com, and GrubHub.

Return

Though the annual fee is increasing by $75, Amex is providing an additional $184 in monthly statement credits, provided that you can make use of them. That brings the total potential credit benefit to $424 annually, on top of a $325 annual fee.

That said, these benefits are designed to encourage/force you to make purchases that are likely to exceed the credit, which will inevitably cause you to spend more on the card. Moreover, you may not even use some of them at all. For example, I rarely ever use rideshares or Uber Eats, so that credit does absolutely nothing for me. And if you live somewhere like Hawai’i island, the dining credit may be next to useless unless you don’t mind paying exorbitant shipping charges.

Statement credits aren’t what this card is all about, though, and its 4x categories still provide great returns. For example, let’s say you spend $12,000 on groceries annually and another $6,000 on dining. Those transactions alone would earn you 72,000 Membership Rewards points. If we value Membership Rewards points at $0.015 each, then you would’ve earned $1,080 worth of points off of groceries and dining alone, which would still make the card worth its annual fee.

Sign-Up Bonus

With the Amex Gold 2024 updates comes a new sign-up bonus. If you haven’t had an Amex Gold before, you can receive 60,000 Membership Rewards points for spending $6,000 within six months from your account opening date, plus 20% back as statement credits for dining purchases at restaurants worldwide up to $100. These two sign-up bonuses are available for applications received through 11/6/2024.

Shortly before the Amex Gold 2024 updates, the sign-up bonus was for 90,000 points after spending $6,000 in six months.

Amex Gold 2024 Updates, Final Thoughts

So, what do you all think of the Amex Gold 2024 updates? I do like the Resy credit, especially since there’s a good collection of spots in Honolulu that use the platform, including Miro Kaimuki, Bar Maze, Bar Leather Apron, and Senia. However, the Amex Gold still isn’t for me. While the card would earn its keep based on just my grocery purchases, the annual fee makes it tough for me to have, especially as I’m trying to minimize discretionary spending. Yeah, I kept the Sapphire Reserve, which makes even less sense, but Ultimate Rewards points are more valuable to me, too.

But, enough about me. Let me know what you think about the Amex Gold 2024 updates.