Citi hasn’t had a super-premium travel rewards card for some time now. However, that changed recently with the Citi Strata Elite Card, but can this card compete with its peers, such as the Chase Sapphire Reserve, the Venture X, or the Platinum card? Let’s discuss.

The Citi Strata Elite has, naturally, been getting a lot of attention. As such, I won’t be doing a deep dive into the card of my own. That said, I think it prudent that we start this post off with a high-level overview of what the card has to offer.

Citi Strata Elite Benefits

Cards of this caliber try to compete on spending bonus categories and other benefits, which cardholders can see a tangible, monetary benefit to. In this regard, the Citi Strata Elite is no different than its peers. However, how it accomplishes these is a bit different. Cardholders enjoy:

- 12x points on hotels, car rentals, and attractions booked via cititravel.com

- 6x points on air travel booked via cititravel.com

- Citi Nights, which gives you 6x points on dining between 6 pm on Friday nights and 6 am on Saturday mornings, and again between 6 pm on Saturday nights and 6 am on Sunday mornings

- 3x points at restaurants outside of the Citi Nights times

- 1.5x points on all other purchases

- Up to $300 off a hotel stay of two nights or more that you book and pre-pay via cititravel.com (annual)

- Up to $200 in Splurge Credit annually, which applies to purchases made directly with activated Splurge Credit merchants. Currently, these merchants include 1stDibs, American Airlines, Best Buy, Future Personal Training, and Live Nation. For American, qualified purchases are those made via American Air or American Air vacations, except for car rentals and hotel reservations, purchase of AAdvantage status boost or renewal, and AA Cargo products and services, while Live Nation includes Ticketmaster, but only for domestic events.

- Up to $200 in Blacklane credits annually, split between $100 from January through June and another $100 from July through December, and must be booked directly with Blacklane

- Up to $120 in statement credits for Global Entry or TSA PreCheck once every four years

- Priority Pass Select membership includes up to two guests per visit. Additional guests will cost $35 each

- Four Admirals Club passes per year for the primary cardholder only. No guesting privileges, so you’ll need to redeem a pass for each member of your party 18 and older. You must also have a same-day ticket for a flight marketed and operated by American Airlines, a oneworld partner, or Alaska Airlines

-

The Reserve Benefits via Citi Travel (Citi Strata Elite, Citi Strata Premier, and Citi Prestige cardmembers):

- $100.00 Experience Credit

- Room Upgrade, upon availability

- Daily Breakfast for Two

- Complimentary Wi-Fi

- Early Check-In, upon availability

- Late Check-Out, upon availability

- To receive these benefits, you must select a hotel room rate offered by The Reserve at check-out

All of the above comes at a cost of $595 per year, plus an additional $75 for each authorized user you add to your account.

My Take

The Citi Strata Elite is, quite obviously, their take on what everyone else is doing – forcing you to book via their travel portal to maximize your points earnings. That said, the number of points they’re awarding you is class-leading, as they’re giving you more than their next closest competitor, the Capital One Venture X. It also gives you more points for non-bonused spend than any of its peers.

In terms of couponing, Citi again takes the lead with up to $1,500 in annual value, followed by Chase at $1,200, then Amex at just under $1,200, and Capital One at $420. I know this is a contentious topic these days, and I agree that it’s annoying. However, at least for my purposes, the Sapphire Reserve offers the best value for me, thanks to its coupon partners and its class-leading $300 general travel credit.

Airport lounges are another major area of competition, with Chase, Capital One, and Amex all offering their own lounges, along with Priority Pass membership. Citi is the outlier, relying exclusively on partners for fulfillment, which isn’t good given how awful Priority Pass availability and accessibility are (though the branded lounges aren’t much better). But, still, Citi is definitely the weakest of the bunch.

Finally, we need to look at transfer partners. For oneworld loyalists such as myself, the Citi Strata Elite provides an unparalleled airline points transfer option, as AAdvantage is now a ThankYou Rewards transfer member, along with Qantas and Qatar. Outside of that, though, the only unique partners they have are Leading Hotels of the World, Eva Air, Preferred Hotels & Resorts, and Thai Airways.

There’s no doubt that having AAdvantage as a transfer partner is fantastic. However, for my travel preferences, especially on the hotel side, Ultimate Rewards continues to reign supreme, with Hyatt as a transfer partner. Being based in Hawai’i, Southwest also becomes valuable for intra-state award travel, especially since no one aside from BILT partners with Alaska Mileage Plan or HawaiianMiles. Though I suppose you could book an award flight with them via Singapore KrisFlyer... But I wouldn’t recommend it, as an intra-Hawai’i award ticket via KrisFlyer costs more than a Hawai’i-West Coast one.

Citi Strata Elite vs Strata Premier

Now, the elephant in the room is whether or not the Citi Strata Elite is worth it compared to its lower-cost sibling, the Strata Premier. This $95 annual fee card doesn’t come with all of the coupons, lounge access perks, etc. that the Elite does. However, what it lacks in perks, it makes up for in earning power:

- 10x points on hotels, car rentals, and attractions booked via cititravel.com

- 3x points on air travel and hotel purchases made directly with the provider

- 3x points on dining

- 3x points at supermarkets

- 3x points on gas and EV charging

- 1x points on all other purchases

For the most part, the Strata Premier doesn’t shackle you to Citi’s travel portal, at least for now. That alone makes it more appealing, as the Strata Elite doesn’t give you the option to book directly and earn a bonus. Plus, the bonus categories, while not as rich, let you earn more on your everyday spending. Which, for the vast majority of us, will likely allow us to build up points balances quicker. Finally, the Strata Premier still allows you to transfer points 1:1 to AAdvantage.

Earnings Example

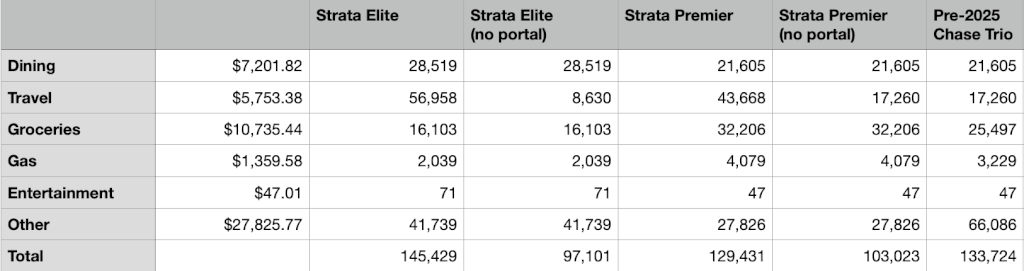

Let’s take some of the above about the Citi Strata Elite and Premier, and extrapolate them to some spending statistics based on national averages, and some stats from my last year of actual travel (2022).

Now, before we get into it, I assumed for the portal categories and the Citi Nights categories that a third of purchases would occur at the maximum bonused value, while the remainder comes in at the non-bonused rate. For the Strata Elite, specifically, I attributed all spending to the portal, but split it between a third for airlines and the remainder for hotels and car rentals.

As you can see, I also included the Chase trio based on the pre-change Sapphire Reserve, just because that’s the historic reference point that I have. That, and they made the categories a bit too complicated for my tired brain to parse out to turn into sample figures. Sorry.

But, as you can see, if you’re a person who would commit fully to the Citi Travel portal, the Strata Elite is pretty hard to beat. However, if you’d rather not use their travel portal, it’s actually the overall loser.

Final Thoughts

There’s no doubt in my mind that the Citi Strata Elite is not for me. This would hold true even if I were still traveling frequently. Its restrictive bonus categories, coupon book options, and transfer partner selections don’t line up with my habits and preferences. And that’s before you consider that, often, booking via a credit card’s travel portal can be more costly than booking direct, and could prevent you from earning or receiving elite benefits.

Though I’m not certain whether I’ll keep my Sapphire Reserve upon its next renewal, what I do know is that I won’t be jumping over to the Citi Strata Elite. Not only is the card not appealing to me, but I’ve had poor experiences with Citi overall, and it seems that I’m not alone in this regard. And if I were to switch, the Strata Elite is more my speed.

For the rest of you, though, what do you all think? Which super-premium card is your favorite? Keep in mind that the above info on Amex is going to change in the near future. After all, after Chase revealed the revamped Sapphire Reserve, Amex basically said, “hold my beer.”