Recently I’ve discovered that not all merchant categories are created equal. And what’s even more confusing is the fact that this can happen with cards from the same issuer.

Navigating credit card bonus categories can be tricky. Merchants don’t always fall under the category you think they will, which can make choosing the right card difficult. What’s even more perplexing, though, is the fact that merchants fall under two different categories depending on the card you use. Even more strange is the fact that this difference can happen with cards that are both issued by the same company and use the same network.

Different Merchant Categories

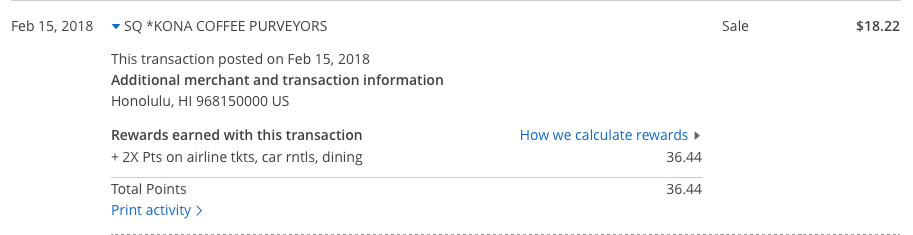

The way I stumbled upon this discrepancy was on complete accident. You see, my spend strategy is a little strange. I charge all reimbursable spend and Marriott spend on my Marriott Rewards Visa. All other spend goes on my Sapphire Reserve, Freedom cards, or my Amex Everyday Preferred. And, last year, when Chase adjusted their dining category, my favorite coffee shop/bakery stopped earning triple points on my Sapphire Reserve. As a result, I shifted my spend at that coffee shop to my Freedom Unlimited.

However, recently I went to that coffee shop for work. So, naturally, I tossed that spend on my Marriott Rewards Visa. And guess what? The transaction earned me double Marriott Rewards points. Same applies to catering spend as well.

Not All Merchant Categories are Created Equal, Final Thoughts

Seems like Chase uses different merchant categories for its co-branded credit cards versus Ultimate Rewards cards. But will this always be the case? Who knows. But for now, it is, and this information is good to know. Would it be better to earn 1.5 Ultimate Rewards points per dollar at bakeries? Perhaps. But it doesn’t hurt to have options. And, personally, I’ve decided to place all such spend on my Marriott Rewards Visa for the time being.