On January 31, Hawaii’s hometown airline held its Q4 2023 and full-year earnings call. Unfortunately, Hawaiian Airlines’ 2023 financial results weren’t good. Of course, we knew this was going to be the case and that they’re expected to remain bad for the next few years.

In 2022, Hawaiian reported a net loss of $240.1 million, which was in stark contrast to the record profits most U.S.-based legacy airlines were reporting at the time. At the time, CEO Peter Ingram blamed increased competition (Southwest) and soft Japanese demand for their performance. Unfortunately, not much has changed since then. Southwest continues to put pressure on Hawaiian, even opening an operations command center in Honolulu, while Japanese demand remains far below pre-pandemic levels. As such, you’d expect Hawaiian Airlines’ 2023 financial results to be similar to 2022, which they were, but they were also worse.

Hawaiian Airlines’ 2023 Financial Results

The net loss reported in Hawaiian Airlines’ 2023 financial results was roughly $20 million more than last year at $260.5 million (GAAP), with $101.2 million of those losses occurring in Q4 alone. In their earnings report, Ingram notes:

Demand is solid across our networks, our brand remains strong in Japan as the market recovers, and we have seen steady improvement in travel to Maui. We expect the combination with Alaska will create an even more competitive combined airline, positioning the Hawaiian Airlines brand to flourish in the years ahead.

Ingram is right; demand remains solid across their network, with passenger revenue increasing 5.3% year-over-year (YoY). However, while I’m sure the Hawaiian brand remains strong in Japan, demand remains weak due to previously covered reasons. In fact, demand is so weak that Hawaiian has forfeited one of its coveted Haneda slot pairs, as it cannot utilize the slots in an economically sustainable fashion.

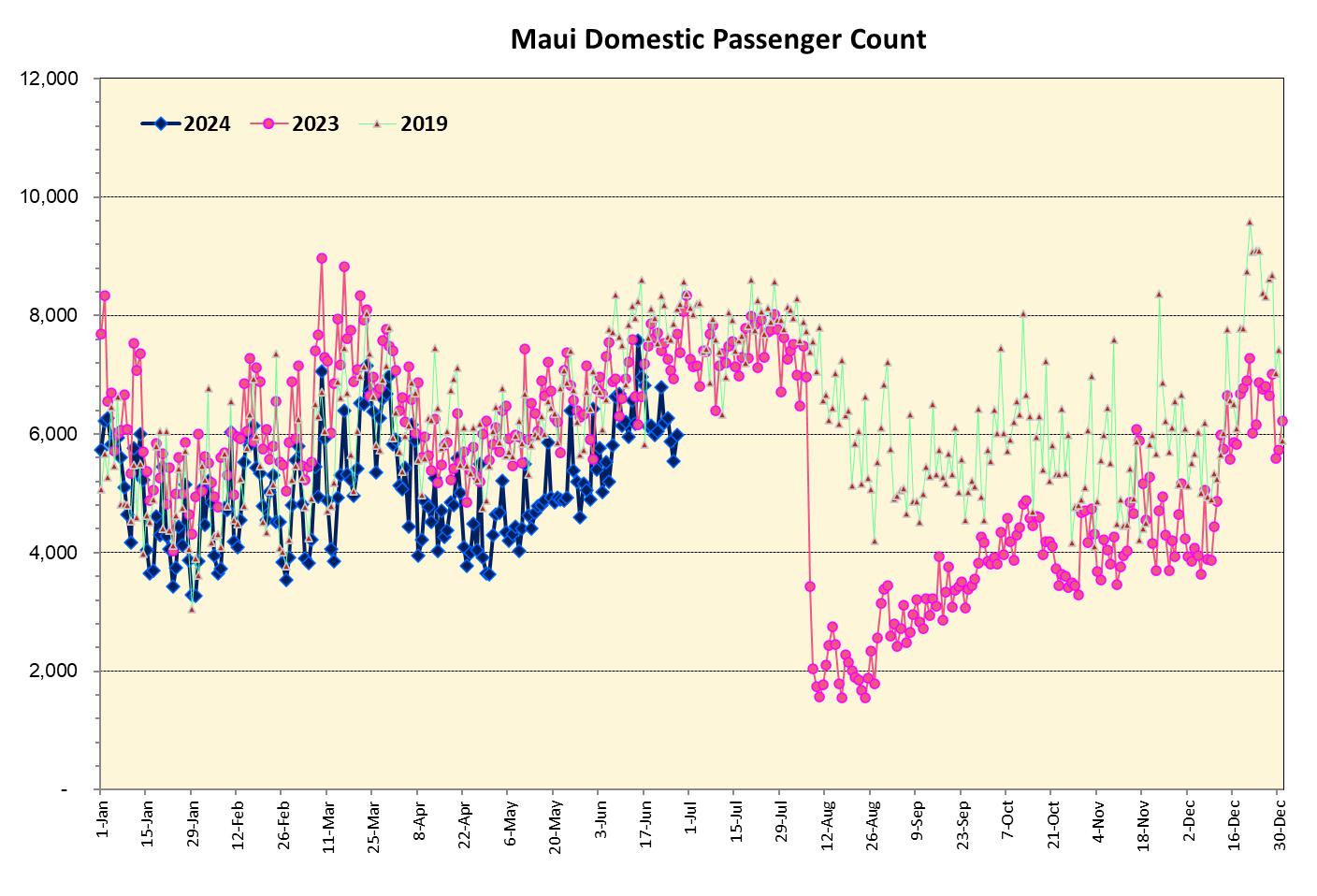

Regarding Maui, demand did (kind of) recover. In December. Still. There’s no denying that the wildfires had an impact on Hawaiian’s financial. YoY passenger revenue increased, but I suspect it could’ve been higher had the fires not happened. In fact, Hawaiian’s Q4 2023 passenger revenue fell 7.6% YoY.

That said, I’m sure this dip isn’t solely because of the Maui wildfires. Hawaiian was disproportionately impacted by the ongoing PW 1100G issues last year, and I’m sure that was a major contributing factor to their Q4 performance. After all, they had to ground planes, cancel numerous flights, and re-accommodate passengers. Strangely, Hawaiian doesn’t mention Pratt & Whitney or parent RTX at all.

Unfortunately, Hawaiian’s revenue growth and lower fuel prices last year couldn’t offset all of the other forces working against Hawaiian. One of these forces was softer cargo demand, which the Airline blames for its 16.2% YoY reduction in non-passenger revenue. The other, of course, was expenses. Aside from exceptions, such as fuel, Hawaiian’s operating expenses grew far faster than revenue last year, with major items like labor jumping by double-digit figures.

To highlight just how disproportionate these changes were, Hawaiian’s operating revenue increased by over $75 million YoY last year. However, labor expenses increased by over $118 million. Of course, it wasn’t just labor that went up; unavoidable expenses such as airport fees, aircraft maintenance, etc., all increased, too. But this example highlights just how bad Hawaiian’s revenue-income disparity is.

Interestingly, a special expense Hawaiian recorded was $10.6 million in legal and consultant fees associated with their merger with Alaska.

It’s worth noting that Hawaiian is ending the year with a liquidity of $1.1 billion, including $908.5 million in unrestricted cash and $235 million in available credit, along with $1.7 billion in outstanding debt and finance lease obligations.

Starlink

Hawaiian Airlines’ 2023 financial results call wasn’t all doom and gloom. There was a bit of good news, too. Specifically, Hawaiian has received FAA approval to install the Starlink system on its A321neo fleet. The Airline is in the process of installing them across its neo fleet and plans to offer the service free to all passengers once it becomes available.

I still think its odd that they chose to install WiFi on their No Engine Option aircraft first. These planes typically fly shorter segments between Hawaii and the West Coast, with the longest one being the insane Honolulu-Salt Lake City route. What they should’ve done was debut the service on the 787, or at least the A330, since those do/will operate Hawaiian’s longest routes. But I guess installing them on planes that are sitting around awaiting critical engine warranty work would be the least disruptive.

How Hawaiian Compares

So, how do Hawaiian Airlines’ 2023 financial results compare to other U.S.-based airlines? Let’s take a look!

- Alaska Airlines: $235 million

- American Airlines: $822 million

- Delta Air Lines: $4.6 billion

- JetBlue: $151 million (loss)

- Southwest: $498 million

- United Airlines: $2.6 billion

Note: I would have liked to include Frontier and Spirit in this report, but none of them had their results ready in time for me to publish this post.

What kind of concerns me is that Alaska’s net income for 2023 is less than Hawaiian’s net loss. I sincerely hope they have a great plan in place because things are going to be rough in the beginning, especially with the way Hawaiian continues to bleed. That said, Alaska’s net income for 2023 is over 10 times higher than it was in 2022. So if they can grow income by even half that this year, they should be ok.

Hawaiian Airlines’ 2023 Financial Results, Final Thoughts

While Hawaiian Airlines’ 2023 financial results are not good, they’re also not unexpected. Industry watchers and the Airlines’ own executives knew this was going to be the case, and will continue to be the case through at least 2026. But it also serves as a potent reminder that Hawaiian is financially unwell and is inching closer and closer to another bankruptcy. Hopefully, things will improve, especially as they receive the full fleet of Amazon Air A330s, though Hawaiian is going to need more than that to succeed. They really need to diversify their business away from being so reliant on Japan, and they need better luck. RTX and the Maui fires certainly didn’t do them any favors last year.