We can probably file this one as coincidence, but I wanted to share an email I received today from Citi Cards. The note is about using my Citi AAdvantage card with Apple Pay, and appears to be a co-branded message with Apple.

This message shows 4 Citi AAdvantage branded cards in an Apple Pay Account.

No big deal, right – we get these messages every single day. I take most marketing messages with a grain of salt, because as a liar marketer myself, I know that these messages are designed to do one thing: get us to buy something.

(For those interested, I have tried to dissect travel related email messages several times on Jeffsetter, trying to get into the minds of corporate marketers, and why they make the messaging choices they make.)

Citi Photoshopped their screenshots and it looks nothing like Apple Pay

I was suspicious of the image that Citi included in their email. It just didn’t look right.

It looked different than Apple’s passbook app, and I didn’t think that Apple Pay would look like this either. I assumed that Citi’s marketing team photoshopped the image for the purposes of their email. This happens all of the time.

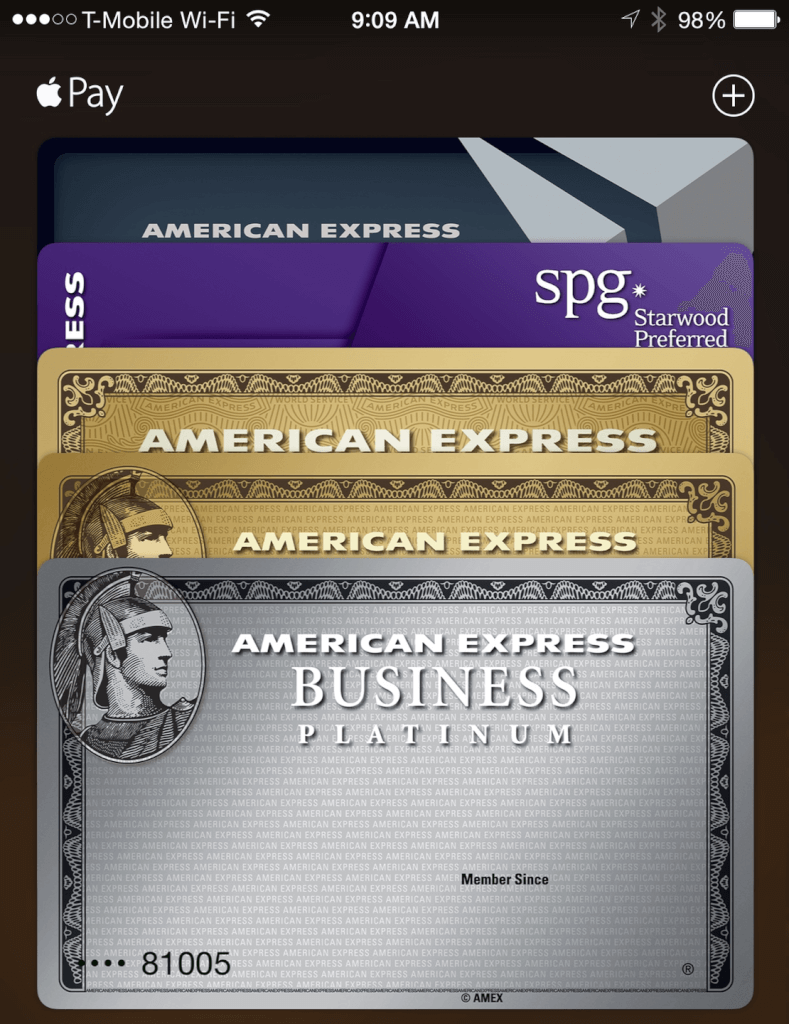

To confirm, I added 5 Amex cards to my Apple pay account and took a screenshot. Here is what Apple Pay really looks like:

As you can see, this looks nothing like the Citi Screenshot from the email.

Does Citi really want everyone to get 4 AAdvantage credit cards?

Now to the point of this post. Citi could have used any image they wanted to share this announcement/marketing message.

The image that they chose to use indicates that their best customers enter 4 Citi AAdvantage cards in their wallet. To have fewer than 4 cards would be incomplete.

But does this reflect the reality of Citi and the number of credit cards they offer consumers? Is it really feasible for a customer to have 4 different cards earning AAdvantage miles?

From my experience (and from what I have read of others), absolutely. Citi wants our business so much that they allow you to have any of these individual cards multiple times.

Putting my marketer hat back on, you can see that Citi is aggressively pushing their products and trying to acquire new customers. Customers they hope will become loyal and continued users of their credit cards.

Citi sees credit cards as a source of profit, and they are in acquisition mode to acquire more customers through their marketing efforts. This is why we see high signup bonuses and multiple applications being accepted for the same card for the same person.

Citi is aggressively going for quantity, much like Chase did in the past

The post to this point could probably have been written 3 years ago about Chase by simply changing the names of the bank. Citi sees profit potential in credit card accounts, and are aggressively going after new customers. For those of us who participate in this game, we stand to benefit tremendously during this growth period, to the tune of hundreds of thousands of points and miles.

We were able to do the same with Ultimate Rewards for years, although that well seems to be running dry as of late.

Bull markets in customer acquisition aren’t limited to credit cards of course. We saw the same thing happen in the middle of the 2000’s, with the aggressive quests for profits leading to the subprime mortgage crisis and the fall of global financial markets.

All good things will evolve

Keeping my marketer hat on, I can tell you how this will unfold.

Year 1 of a customer acquisition marketing effort

Marketers have free reign to acquire new customers. In order to hit their goals as marketers, they go after quantity over quality. This means relaxing rules for accepting a new customer and not really doing much to prevent fraud or other user activity.

The bean counters at the company may be a little skeptical over this approach, but they trust the marketers to do their jobs. Marketers do whatever they can in order to grow the business and get their bonuses.

It is easy for people watching on the sidelines (like my armchair analysis here) to see that this approach is not the most profitable or best use of resources, but the company does not have the same insight. They have blinders on to outside influence.

Why? Because even if we have seen this happen negatively to another company in the past, that data is proprietary. The company trying to acquire customers today does not have the same repository of data at their disposal to make smart decisions. So it’s pretty much the wild west.

Year 2 of a customer acquisition marketing effort

Marketers plan budgets for Year 2 well before Year 1 is complete. They often get budget approval before even seeing the profit and loss statements for the business. They definitely do not have a full year of retention data to understand if their new customers are profitable.

When financial statements come out for Year 1 (some time in Year 2), they can see that the program is not profitable in Year 1. The customer lifetime value argument is invoked. After all, this is a long term business plan. No customers are profitable in year 1.

Budget may be reduced after the financials come in, but the marketers will argue that this budget is necessary to execute their growth plan. They argue that there is no way they can reach their goals (and achieve bonuses) without proper budget.

Year 3 budgets are set before anyone is certain that this business unit can even be profitable.

Year 3 of a customer acquisition marketing effort

Marketing efforts will often continue into year 3 with the same level of aggressiveness that was seen in year 1, with only a few minor adjustments in place to block obvious fraud and abuse of the system. The first full year of data (year 1) becomes available. Analysis of customers takes place.

It turns out that 95% of customers are break-even or profitable. They pay annual fees, use the cards as planned, and are on a path to a profitable lifetime value.

Then there are the 5% of users who take advantage of the system and are extremely unprofitable. These 5% of customers are eating up the profit of the other 95% of customers, combined.

Sophisticated models are put in place to determine what types of customers are unprofitable. It is obvious who these customers are on the surface, but it takes a data driven effort to have evidence of bad customers.

Recommendations are made to the company that in Year 4 these unprofitable customers are mitigated or banned from the program entirely.

Year 4 of a customer acquisition marketing effort

The company implements models to make their customer acquisition efforts profitable, based on their now rich customer history that contains 3 years of historical data. The best customers are encouraged to remain loyal, but not given any significant rewards for their loyalty (don’t rock that boat, just milk the cash cow). The worst customers are phased out of the program, either by their own attrition or by blocking their ability to apply.

Year 4 ends up being an extremely profitable year for the program. Quality data models are in place based on proprietary data, models, algorithms, etc.

Everything is going great, until the competition decides that they want to acquire their best customers. The competition aggressively targets new customers, using the tactics that the same company used in year #1 of their effort. Money is being thrown at customers, and there is little to no accountability for where this money goes.

Year 5 of a customer acquisition marketing effort

Growth of new customers stopped entirely in year #4 as the company focused on profit over growth. This sounded great on paper, until the competition started their aggressive marketing. Now the company CEO is wondering why growth has stalled!

Pride is on the line. Customers are leaving for the competition. Bonuses are dried up, because nobody can match their prior growth rates.

The company decides that the only reasonable thing to do is chase new customer growth at the expense of profit. Or they decide to phase out this aspect of the business entirely.

Future years of the program

Acquire customers with bonuses, but also limit your risk by applying the data driven algorithms you developed based on several years of knowledge.

Limit the ability for customers to receive the same bonus multiple times.

Encourage your best customers to stick around (but keep them profitable).

Customer acquisition is a moving target

I have helped create marketing campaigns in several industries that have the business model that I outlined above, and I have personally witnessed this cycle happen in each of them.

This happens in insurance (billions spent each year in acquisition, and it can take 7 years for an insurance client to turn a profit). This happens in financial services. It happens with banks.

Without competition, customer acquisition would be easy. Because of competition, we can benefit tremendously as consumers.

Let’s put some names to this theory

My dates may be a little off, but the above scenario sounds a lot like what we are seeing from Citi, Chase and American Express with their customer acquisition methods. I mention these because I am most familiar with their programs, although I am sure we could include US Bank, BarclayCard, Wells Fargo, etc. in here as well.

Citi is somewhere between Year 1 and Year 2 of what I described above. They are still in hyper growth mode and want to acquire customers, doing whatever it takes.

Chase is in Year 4 of what is described above. They are becoming more selective with customer acquisition and have rules in place to block out certain types of customers. This explains the tightening of the belt with applications recently.

American Express is in the “future” phase of their program. They know the model of a profitable customer and know what it takes to get them. They are the most mature program of them all from an acquisition standpoint. They realize that bonuses are important to acquire customers over the competition, but are selective about it.

Predicting the future

Much like in the airline industry, competition is our best friend. Credit cards are an extremely profitable business for banks. It is profitable for airlines too. (If it were not profitable, then would not be writing this from a free hotel room on Oahu right now, that I received by transferring Ultimate Rewards points to Hyatt for 2 nights and then used my Chase Hyatt visa annual free night for the 3rd night of our stay. I would probably be writing this from a cardboard box otherwise.)

As long as there are banks who want a piece of that lucrative credit card business, we will benefit as consumers.

But we will benefit differently by knowing which phase these businesses are in their customer acquisition. Understanding the outline above, you can see that there are two times to maximize this opportunity:

- Target companies who are in years 1 & 2 of their customer acquisition plans and drink from that firehose. The theory here is to maximize your efforts before it catches up with you, and I can see merit to this theory for many people.

- The second opportunity is to selectively target the companies that are in their mature phases and spread your business across many banks to stay in good graces of all of them. This is by far the best long terms strategy, but requires patience that many of us do not have.

The best strategy is to employ the one you are most comfortable with, which I think varies for everyone. You should feel no pressure to act based on what others say. But I do hope that with this post you have more insight into how things work inside the companies competing for your business.

Knowledge is power. If someone is advertising to you or sending you email messages, they are seeking to profit off of you. It’s that simple.

Use this to your advantage or someone will take advantage of you.

Interesting post. The companies I’ve worked for, on the finance side, have a bit of a shorter cycle, but the ideas are the same.