What’s the difference between credit cards and charge cards? A lot, actually, even though many use the terms interchangeably. But not to worry, the differences, while large, are few and are easy to understand.

Charge cards have been around longer than credit cards. However, credit cards have since become the preferred option for most consumers. This is thanks to the flexibility offered by credit cards, which allows cardholders to pay over time. And that’s the most significant difference between the two. But let’s take a deep dive.

To make this comparison even more straightforward, I’m going to compare two American Express products. Why American Express? Because they’re really the last issuer of charge cards, at least here in the U.S.

Credit Cards

In my collection, I have two American Express credit cards, though I only use one. That card is the American Express EveryDay Preferred, which has outstanding Membership Rewards earning abilities. But like credit cards from any other issuer, the way in which you use the card is very much the same.

Purchases

During your billing period, usually a month, cardholders may charge purchases to their credit card up to their credit limit. Some cards will allow you to exceed your credit limit without penalty, though you’ll need to pay off your minimum payment and the difference between your charges and credit limit by your due date.

Due Date and Minimum Payment

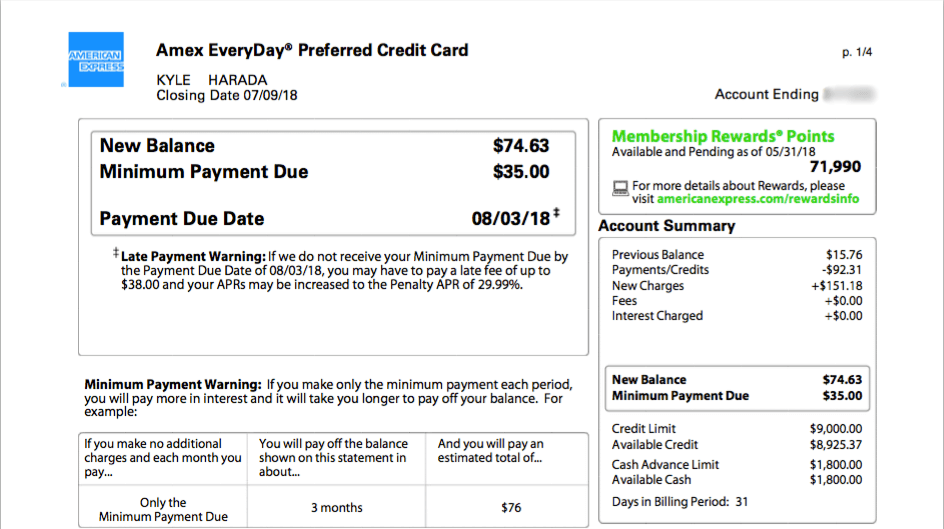

Once your billing period closes, your card issuer will provide a statement. There you’ll find your due date, which is typically 28 days after your closing date. And, in addition to presenting you with your total balance, you’ll be presented your minimum payment due. This figure is typically a percentage of your overall balance, which varies by issuer and product. There is often a minimum dollar amount too, though, if your balance is too low for a specific percentage.

Making Payments

With credit cards, you’ll need to make at least your minimum payment by the due date. I’d recommend paying off your balance in full every month, but if you aren’t able to, you don’t have to. You can choose to “revolve” your balance, which is to carry it over into your next billing period. If you do so, though, you’ll accrue interest. Failing to pay on-time will result in a late payment fee, which is usually a percentage of the outstanding balance or a fixed fee, whichever is lower. For the EveryDay Preferred, the late fee is up to $38 in the case of this card. But, beyond the late penalty, card issuers may also charge you a penalty interest rate, usually something around 30% APR or more.

Interest

The biggest difference between charge cards and credit cards is the ability to revolve your balance. But, revolving your balance, also means accruing interest. And with interest rates hovering around 16% to 18% for well-qualified cardholders on the most desirable cards, that can add up to a lot of additional expenses.

For example, if your annual percentage rate (APR) is 16%, your daily APR will be 0.044%. This means for a balance of $100, you’ll accrue interest of $0.044 per day. Sort of. You see, the interest can compound monthly or daily. And if your interest compounds daily, then instead of accruing $12.30 in interest on a balance of $1,000, you’ll accrue interest amounting to $12.40. That’s not a huge difference, but it adds up, especially on higher balances.

Annual Fees

A vast majority of credit cards have no annual fees. But if you want premium perks and rewards, then you’ll usually end up paying an annual fee. These can range from $50 up to $450 or even more. Personally, I have cards with annual fees ranging from $75 to $450, though all provide more value than the amount of their annual fees.

Charge Cards

American Express offers three consumer charge card products, the Green, Gold Premier Rewards, and Platinum cards. And while these are all very different cards in terms of benefits and rewards, they all operate the same way.

Purchases

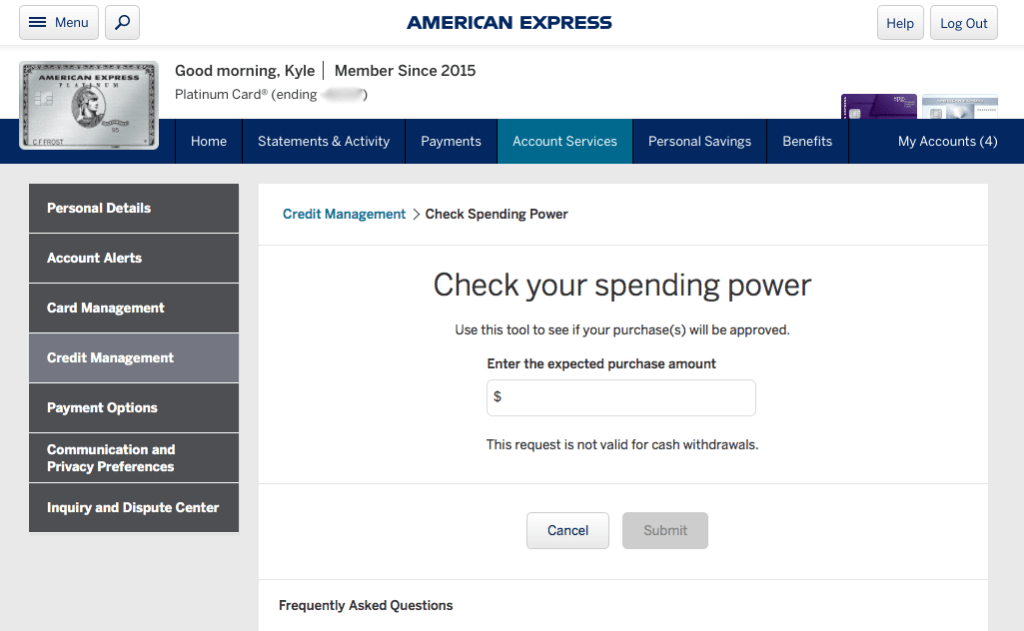

Much like with credit cards, charge card cardholders may make purchases on their card throughout their billing period. However, unlike credit cards, charge cards often don’t have a preset spending limit. Instead, Amex has a tool to check your spending power. Your spending power, by the way, is calculated based on your income and other financial assets. So be sure to update Amex anytime either of these variables changes.

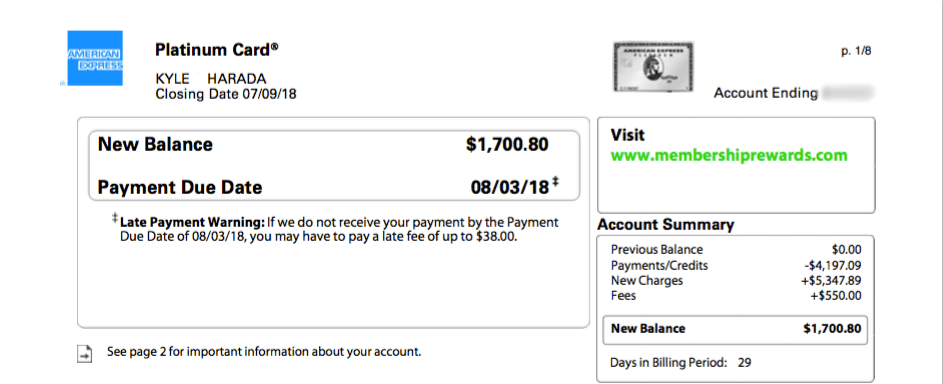

Due Date

Also similar to credit cards, charge cards have a billing cycle, which is typically around a month as well. Even your payment due date is similar to credit cards, usually being around 28 after your billing period closes. However, unlike credit cards, there is no minimum payment due. Instead, your ENTIRE balance is due by the due date. Cardholders cannot carry balances into the next billing period, though Amex sometimes makes exceptions.

You’ll also notice that the Amex Platinum’s statement summary is a lot shorter than the EveryDay Preferred. This is thanks to the card not charging interest, which, again, is a result of it allowing cardholders to carry a balance.

Interest Rates

Because charge cards do not let you carry balances, they do not charge interest. If you fail to make your payment on-time, though, you’ll still be charged a late payment fee. And, again, like credit cards, this late payment fee is a percentage of your outstanding balance or $38, whichever is lower.

Annual Fees

This is another big differentiator between charge cards and credit cards. That’s because, at least in the case of American Express, all charge cards carry an annual fee. The Green is $95, the Gold is $250, and the Platinum is $550. However, both the Gold and Platinum provide other benefits, such as reimbursements, that significantly reduce the effective annual fee. For example, the Gold provides cardholders $100 in statement credits for airline fees and $120 for restaurant purchases, reducing the effective annual fee to $130.

The Difference Between Credit Cards and Charge Cards, Final Thoughts

Realistically, no one is going to get a charge card unless you want an Amex Gold or Platinum (or even the Centurion, but you can’t apply for that card). They just aren’t that common anymore, especially because credit cards offer the same convenience and more thanks to the payment flexibility they offer. Plus, there are exceptional nowadays, like the Chase Sapphire Reserve, which has one of the best reward programs around, as well as excellent cardholder benefits. However, if you’re looking for something that offers unique benefits, such as an unrivaled concierge service, then a charge card like the Amex Platinum is for you. Hell, even the Amex Gold is worth having in your wallet for restaurant and grocery store spend.